News

What are the new pet rules? How far are they fair?

What are the new pet rules? How far are they fair? Noida, Ghaziabad, and Gurugram civic bodies have adopted strict rules after a spike in dog attacks and bites in recent times. But how far can these laws stem the menace? Here’s all you need to know. After a surge in dog attacks and bites […]

BEST HOSTING - VPS

Namecheap Review 2023: Pros, Cons and Alternatives

Namecheap Review 2023: Namecheap is a popular provider of domains and other free website builder services including SSL, hosting, and email service provider options. Like many other hosting providers, Namecheap simplifies how a small business launches its site and services, however, there are limitations to their services. Namecheap review is budget-friendly, but the platform is […]

Cat Is Dog

What are the new pet rules? How far are they fair?

What are the new pet rules? How far are they fair? Noida, Ghaziabad, and Gurugram civic bodies have adopted strict rules after a spike in dog attacks and bites in recent times. But how far can these laws stem the menace? Here’s all you need to know. After a surge in dog attacks and bites […]

opinion

Laura Woods swiftly rejects Charlie Brake after he asks her out for dinner

Laura Woods brutally rejects Love Island star Charlie Brake with a savage put down after he asked her out for dinner on Twitter. Laura Woods brutally rejected Love Island star Charlie Brake after he asked her out on Twitter on Monday. The broadcaster, 35, was in high spirits after her beloved Arsenal beat West Ham […]

Preventing monkeypox transmission between people and pets

The 2022 outbreak of monkeypox has caught the attention of healthcare professionals worldwide, especially after the World Health Organization’s declaration of monkeypox as a public health emergency of international concern in late July. Additionally, the first confirmed case of monkeypox in a 4-year-old greyhound appears to confirm that the viral disease can also be transmitted […]

Trending Post

Preventing monkeypox transmission between people and pets

The 2022 outbreak of monkeypox has caught the attention of healthcare professionals worldwide, especially after the World Health Organization’s declaration of monkeypox as a public health emergency of international concern in late July. Additionally, the first confirmed case of monkeypox in a 4-year-old greyhound appears to confirm that the viral disease can also be transmitted […]

celebrity

Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair

Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair. She is not afraid of showing off her incredible curvy physique. And Thursday night was no different for Megan Barton-Hanson who strutted her stuff down the streets of Mayfair in a busty see-through bodysuit and green cargo trousers. The […]

MAYBE YOU LIKE IT?

Gmail creator Paul Buchheit predicts A.I. bots like ChatGPT will destroy search engines within 2 years

A.I. chatbots such as OpenAI’s ChatGPT could make typical search engines obsolete within two years, according to Gmail creator Paul Buchheit. Buchheit explained in a Twitter thread that he predicts the future of web search as we know it right now could be completely upended by 2025. In his words, we’re only “a year or […]

This is an industry where fast-talk is acceptable and double-talk is expected

This is an industry where fast-talk is acceptable and double-talk is expected. MBW’s Inspiring Women series profiles female executives who have risen through the ranks of the business, highlighting their career journey – from their professional breakthrough to the senior responsibilities they now fulfil. Inspiring Women is supported by Ingrooves. Mari Davies, Live Nation Urban’s VP […]

-

pendik escort commented on Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair: You’re so awesome! I don’t believe I have read a s

-

pendik escort commented on Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair: Harika bir paylaşım, özellikle konunun önemli deta

-

Young Fida commented on Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair: betine giriş https://twitter.com/betinegiriss

-

Robertmig commented on This is not your grandfather’s student loan: https://virtual-local-numbers.com

-

çim biçme makinesi commented on Megan Barton-Hanson struts her stuff in a busty fishnet sheer bodysuit at lavish dinner in Mayfair: Selçuk Makina Bahçe Aksesuarları ve Yedek Parça |

Search In This Website

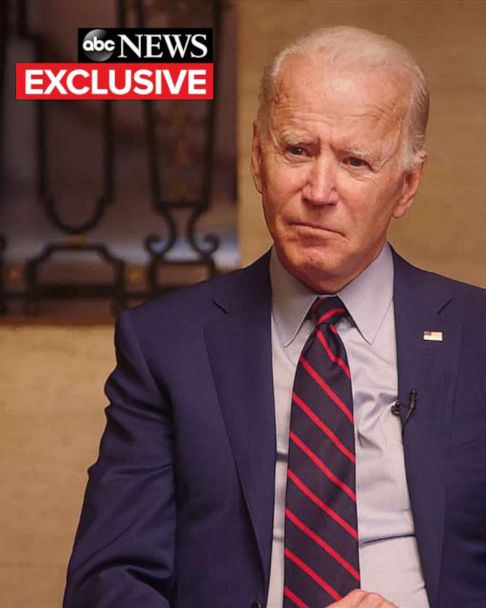

BIDEN DELIVERS REMARKS FOR UKRAINE

Latest Posts